In the affiliate marketing and ecommerce space, the “average order value” metric tells an important story about the health and potential of your offer. Read on to find out more about the AOV and how you can make it a lot higher!

[hubspot portal=”5154711″ id=”7642b9fe-5d46-49e7-aa54-737c33f9221c” type=”form”]What is Average Order Value in Ecommerce?

If you’re a product owner, you always have a LOT of different things to keep track of – but almost nothing is as important as your offer’s average order value!

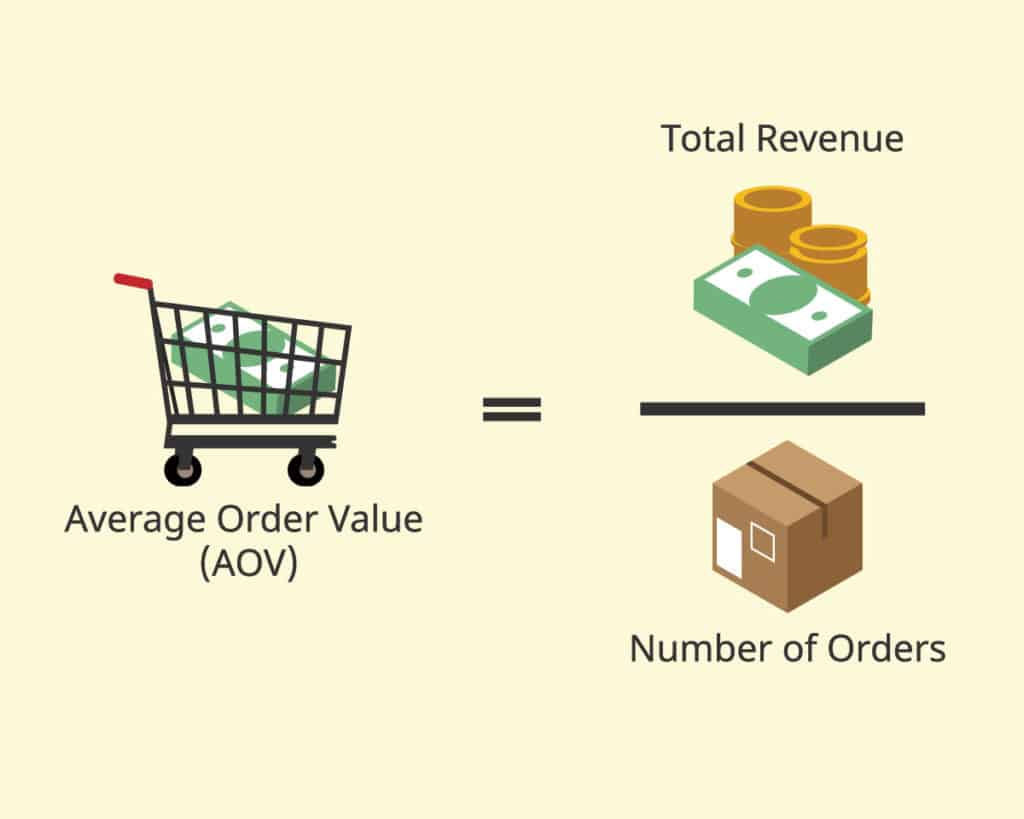

Here’s a quick definition:

Average order value = Total revenue divided by number of orders.

Simple, right?

But we can be even more precise. At ClickBank, we clarify the definition of AOV like this:

The average amount that a customer spends when they go through your funnel and complete a purchase for the first time.

For example, if your total revenue in a month was $5,000 on 100 initial orders, that means that – on average – each order was worth $50 that month.

Of course, keep in mind that the AOV could be skewed by a few high value orders, or conversely, a few unusually low value orders.

If you have the capability, it’s a good idea to look deeper at the data and possibly throw out any outliers that may be pulling the average to one end or the other. Segmenting the data can also help build a more accurate picture of what may be affecting the AOV calculation.

Now that you have a general understanding of AOV, let’s dive a little deeper!

The Two Parts of AOV

For direct response marketers, there are often two parts to AOV: the initial average order value, and the total average order value. This is because many funnels include one or more upsells after the initial purchase, which can drive a higher total AOV.

Looking at both initial AOV and total AOV independently can help sellers figure out where there is the greatest potential to increase their revenue.

At ClickBank, we had a chance to do our own data analysis on top vendors – and we discovered that the initial average order value plays the most critical role in getting order value numbers up.

The insights were shared in our Rundown Report. According to the report, it may not be prudent for product owners to rely too heavily on their upsell:

“The best of the best don’t rely on upsells to increase their order value. Instead, they focus on their initial cart value. In fact, the top 10% of ClickBank Top Earners have an average initial order value of $406.52.”

Click Here to Download the Full Q3 Rundown Report FOR FREE

An average initial order value that large may seem unrealistic if your top priced product is $75, but take the ratio into perspective:

The same group that had an average initial order value of $406.52 only relied on upsells for 8.45% of their total AOV. That means for someone with an average total AOV of $50, their average initial AOV would be $48.78.

While numbers and spending thresholds vary wildly between industries and niches, for ClickBank data analysts, the big takeaway from the recent data was that the pros and top earners don’t always rely on upsells to increase their AOV. The focus must start with the initial order.

Or, put another way:

“Don’t rely on the upsell.”

AOV vs. LTV

There’s another key metric that adds some nuance to the discussion: customer lifetime value (LTV).

Here’s a quick definition of lifetime value:

“Lifetime value” is a measure of how much a customer is worth for their entire lifetime as a customer with you.

If AOV represents your short-term profit potential, the LTV represents your overall profitability in the long term.

Ultimately, you’ll see a lot more profit from customers who buy from you over the long term, which is why the LTV piece is so important. It’s sort of like a grocery store promoting a loss leader on steak around the Fourth of July – you may not even break even on the cost to acquire a customer on a typical initial order, but if you have a high enough LTV, the math still works.

Ultimately, in the affiliate marketing space, the idea is to price your product high enough that you can offer a high commission % (and overall, a high payout) to affiliates who help promote your offer.

The higher the AOV is at the very start, the more you can pay to acquire the customer (which includes paid media and the use of affiliates). It’s actually a common friction point we see with vendors trying to keep the initial costs low, but this can affect your backend profits – as well as your ability to scale an offer with affiliates.

There’s a tight balancing act to manage here. With that in mind, what are some ways you can take what you learn from your own data analysis and increase your average initial order value?

Top 5 Ways to Increase Average Order Value

Overall, the average order value (AOV) is a key metric that can quickly tell vendors the status of their offer. However, just like conversion rate, it doesn’t tell the whole story! You may have a high conversion rate and an abundance of traffic, but profits may still be lagging.

Whatever your situation as a seller, it’s important to learn how to increase the amount of money people are spending on each order. Check out these 5 key ways to boost your average order value!

Tactic 1: Create or raise your order limit for free shipping.

These days, it seems like everything ships for free, so it can be nerve-wracking to create or raise an order limit for free shipping. But with the right combination of products or an optimized offer funnel, you can effectively move buyers to increase their initial order value to reach that threshold.

One way to make sure you’re increasing the initial order value – and not cart abandonment – is to make sure strategically priced items are front and center and attractive as an impulse buy. If people are trying to reach a free shipping price threshold, they likely do not have the patience to shop sizes, colors, and cuts to find just the right item to put them over the limit. Make it as easy as possible!

Tactic 2: Cater to your current buyers.

Another way to increase your average initial order values is to go back to the basics and do a little more market research. If you have enough data to calculate a meaningful and statistically significant AOV, then you have enough data to figure out who your primary customers are. That’s one of the biggest benefits of being an active vendor: tangible data on people’s buying habits in your target audience.

With your new insights, you can tailor your products or your offer to better fit your current buyers, as well as any new buyers you may attract. Market research is a priceless tool that can help you leverage up and coming trends, as well as classic marketing tactics that can create and maintain customer loyalty.

Tactic 3: Try bundling.

Bundling is a powerful tool that, when done right, can have a big impact on your average initial order value. The key to offering an enticing bundle is to communicate the value of the bundle correctly. Take the example Derek Gleason uses in his article, “Product Bundling Strategy: How to Get it Right”:

Here’s the classic example: A $750-per-night hotel charges $10 for a bottle of water. Consumers feel ripped off. However, that same hotel room for $760 per night including water seems like a reasonable deal.

If you have a product of value that has some “major friction” – as Gleason says – then adding it into a bundle with the more expensive main item can reduce buyer apprehension.

This is only one of many bundling tactics. Bundling, like many marketing practices, has deep psychological roots that delve into human behavior. While the science is fascinating, if you don’t have time to read a peer-reviewed paper, it’s wise to consult some experts (or at least their blog posts) when you start offering bundles.

Tactic 4: Offer personalized plans.

If you have the capability to add personalization to your offer, then you may have found your golden ticket to increase your average initial order value.

Ecommerce has largely stripped the buying experience of the intimacy that people might get with a one-on-one in-person sales encounter. You can add a dash of that back in by offering customizable elements to your products or your offers flows.

Individualization is the preferred meal of the ego, so the potential to feel special can help your buyers spend a little more. However, if the quality of the personalization feels gimmicky, you risk a poor product experience.

Like bundling, do a little research when it comes to personalization options and find the one that works best for your product and offer.

Tactic 5: Focus on brand experience.

The last suggestion on our list is the most important:

You have to focus on brand experience. From your UX design to your product quality, focusing on brand experience is the only long-lasting tactic to retain customers who will buy more because they trust your sales process and your product.

A study by Dimension Data found that 92% of companies who focused on improving customer experience saw a growth in revenue.

Customer trust starts at the first brand touch. One bad experience can turn a potential or current customer off for a lifetime. By focusing on brand and customer experience – from start to finish – you’ll have people coming back and, over time, you’re guaranteed to see the needle move on your average order value.

Common ClickBank Average Order Value Benchmarks

While it’s important to consider your AOV, it’s also helpful to have a frame of reference. After all, you only have a narrow range of possible order values based on the products available in your upsell flow – in some cases, you may have just one or two.

At ClickBank, we see enough offers to know what kind of order values you should aim for across both digital and physical products. Here are some targets to keep in mind!

Digital Products Average Order Value

In the digital products realm, we often see the $37 ebook as an initial digital product. It’s a common price point that does well.

Typically, we see an average order value of $50-60 on these (with upsells included), along with a typical conversion rate of roughly 2.5% and commissions at or near 75%.

As you probably noticed, you aren’t going to see a lot of profit with this AOV – in effect, you can use your offer to cover the costs of building a list. This is much more of a long-term focus on monetizing those customers over time. Profits come later.

Ultimately, if your AOV is lower, then you’ll need a higher conversion rate to make it work out. Ideally, you should be hitting payouts of $50+ for a digital product if you want to scale with affiliates – this is because media buyers actually need some wiggle room to experiment and test and learn about what works with your offer before they actually start to make money on it.

Physical Products Average Order Value

Physical products come in all different shapes, sizes, and types. But right now, we’ve seen a LOT of vendors have success with health and fitness supplement products on ClickBank. These are usually available in 1, 3, and 6 bottle SKU’s.

The average initial price on the checkout is $80-120, and the AOV is in the $120-180 range, with commission payouts usually at or near 65%.

This is a ballpark number, so don’t take it as gospel. But if you’re able to get your offer to an AOV of $150+, you’re in great shape to start scaling with affiliates.

(And don’t forget about the possibility of combining the two. Many sellers see the most success when pairing digital offers with physical products to increase AOV and reduce the refund rate.)

Average Order Value FAQs

Why is average order value important?

It comes down to two things: 1) A higher AOV means more money in your pocket with every sale; and 2) It allows you to attract bigger affiliates to scale your offer and make more overall. Along those same lines, a higher order value gives you and your affiliates some wiggle room in how much you can spend acquiring new customers, which is huge in this day and age of rising advertising costs.

What’s the difference between AOV vs APV?

We’ve focused on the average order value (AOV) in this post, which is the most important number for vendors. However, there’s also the APV, or average payout value, which is particularly important for affiliates. AOV is the bigger number, referring to how much a customer spends on average per order – while APV refers to how much money an affiliate will receive in commission, either on a cost per action (CPA) basis or as a percentage of revenue (RevShare) basis.

Obviously, the higher both numbers are, the easier it’ll be to attract affiliates.

What’s the difference between AOV and LTV?

We touched on this before, but think of AOV as how much you’ll make on your first sale, and LTV as how much you’ll make on a typical customer in total. While it’s ideal to make a profit from day one, some vendors are fine breaking even or actually losing money on that initial order, as long as they have a high enough LTV to make up for it later.

Average Order Value Wrap-up

We hope this guide about the average order value metric was helpful! For more information, go read our guide to earnings per click (EPC) or check out our post on the top 8 affiliate marketing metrics you should track.

Lastly, keep in mind that we share the latest AOVs on all of the ClickBank top offers in our monthly top products update every month. That’s a great place to get information on what some of the top-performing ClickBank products are doing. Good luck finding a better AOV!

NOTE: For a full breakdown of more than 67 affiliate marketing terms like AOV, check out ClickBank’s official affiliate marketing glossary!

Do you want to ignite your digital marketing career? We recommend Spark, the only ClickBank-endorsed education platform. Spark has over 70 videos that harness the power of ClickBank’s two decades of expertise and is the best way to shorten the time between now and your first ClickBank paycheck.