TABLE OF CONTENTS

- CPA Seller Guide

- What Is CPA on ClickBank?

- Getting Started With CPA

- When Should You Offer CPA to Affiliates?

- Making Sense of CPA Commission and Returns

- An Example of CPA vs. RevShare in Action

- 6 Insights from Expert CPA Seller: Mike at Biofit

- CPA FAQs for Sellers

- One Affiliate Can Change Your Trajectory

- CPA Seller Guide Conclusion

CPA Seller Guide

In this official ClickBank CPA seller guide, you’re going to learn advanced tactics of how to implement, grow, and scale your CPA offers.

Whether you’re new to offering a CPA commission structure or you’ve sold CPA offers on other platforms, this guide will give you everything you need to know to get up and running with CPA on ClickBank!

As a quick refresher, ClickBank announced the official rollout of our platform’s cost-per-action (CPA) commission structure in June 2021.

Since then, the feature has seen steady adoption from many of our top sellers looking to provide a CPA commission option for their affiliates.

But for every seller who’s embracing the CPA option, we probably see three or four who want to know more about it and why it’s worth doing at all!

So, in this guide, we’re going to primarily focus on the strategy of CPA, rather than terminology or definitions. If you’re looking to brush up on those, we have a whole article about CPA marketing you can check out.

Bottom line: Yes, we’re excited to introduce more sellers to our amazing new CPA feature, but this guide is really about doing what’s best for your business. That’s why we interviewed the top CPA seller on ClickBank for his expert insights – stay tuned for those!

What Is CPA on ClickBank?

Even if you’re familiar with the concept of CPA commissions in general, that doesn’t mean you understand the nuts and bolts of CPA on ClickBank.

In case you’re unaware, CPA represents a flat commission payment per “action” – in this case, a successful initial sale – rather than a percent of total order like in the revenue share (RevShare) model.

There’s another key difference to be aware of: In RevShare, both sellers and affiliates share the cost of refunds and chargebacks. In CPA, sellers alone shoulder those costs.

For a quick breakdown, check out the CPA vs RevShare chart below:

| % vs $ | Responsible for Returns |

Burden of Math |

|

| CPA | $ for Affiliates | Seller | Seller |

| RevShare | % for Affiliates | Both | Affiliate |

Ultimately, the big downside to CPA for sellers is the risk of losing money from affiliate sales.

How?

It’s possible to pay too much commission per sale if you end up with a lower-than-expected average order value or higher-than-expected rate of refunds and chargebacks. That’s why it’s so important to understand when and how to use ClickBank CPA to maximize its benefits and minimize its drawbacks.

Check out our in-depth guide on CPA vs RevShare to learn more about how the two commission models compare.

Getting Started With CPA

We’ll go into CPA strategy shortly, but let’s quickly cover the nuts and bolts of CPA on ClickBank.

Unlike with other CPA networks, any product can be a CPA offer on ClickBank. As a product owner, you have the power to enable CPA on a per-affiliate basis, which means you can make CPA available to just a single high-powered affiliate or a select handful of affiliates. You can even make your offer CPA-only (with no RevShare option at all).

What’s more, you can simultaneously make your offer available on CPA for specific affiliates and open it up via RevShare for everyone else! This is the kind of unique flexibility our sellers appreciate as they look to maximize profits on the ClickBank platform.

Think of CPA on ClickBank like a “commission setting.” It’s just one of many commission tools in your toolkit, along with Commission Groups, to give you the ideal setup for success on ClickBank.

The one caveat here is, if you’re new to ClickBank, you’ll need to establish a sales history before you can offer CPA. This is due to the fact that CPA on ClickBank works a little differently from CPA on other networks.

With ClickBank, because we pay out the commission at the time of sale – directly from the proceeds of the transaction – we need to have a sales track record first for our CPA Commission Calculator to work.

On the plus side, because CPA is pulling from sales history, nobody needs to put up money as a deposit to use the CPA feature.

When Should You Offer CPA to Affiliates?

Now that we’ve talked about how CPA works on ClickBank specifically, let’s dive into when it makes sense to offer CPA as an option for your affiliates!

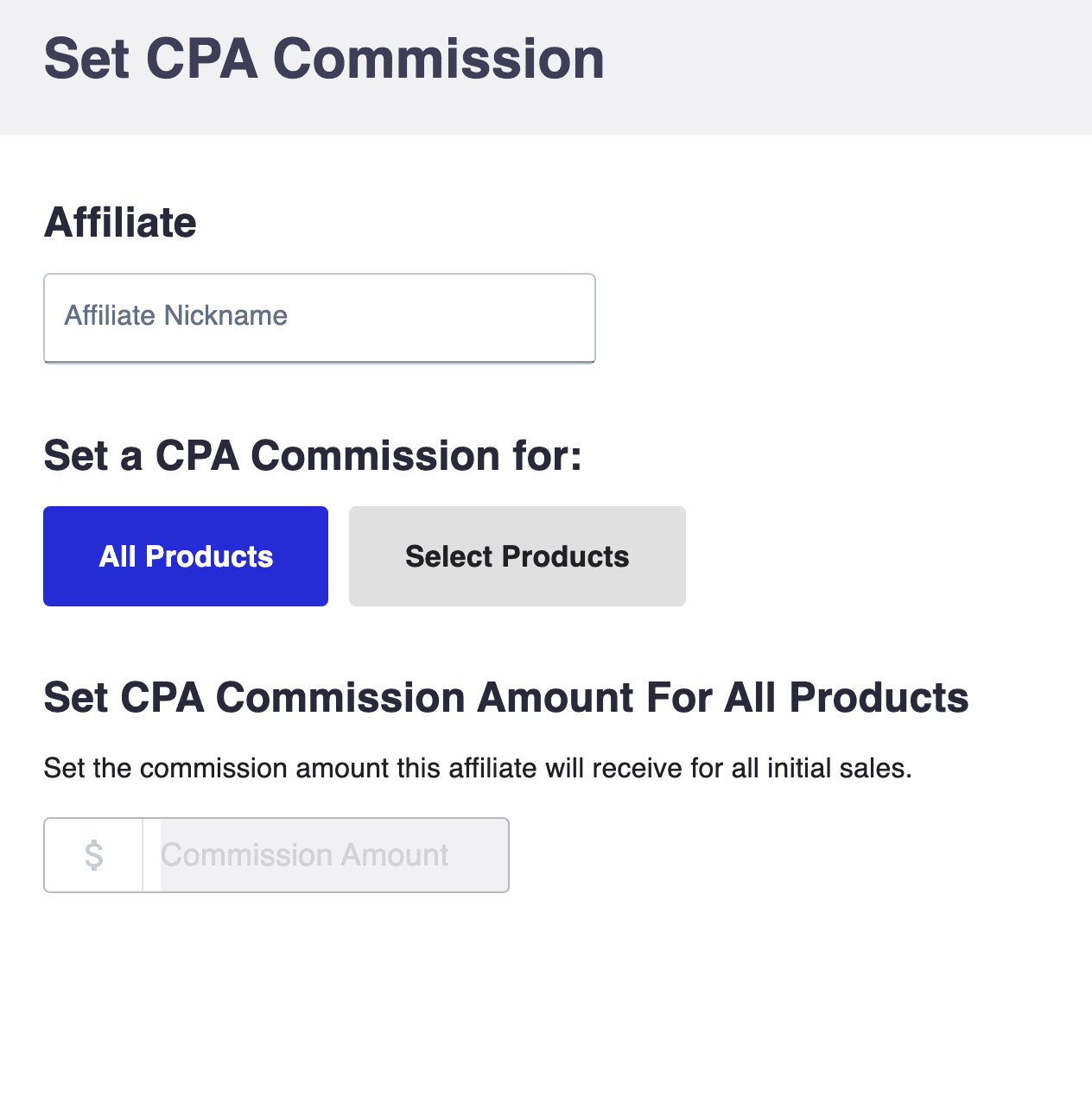

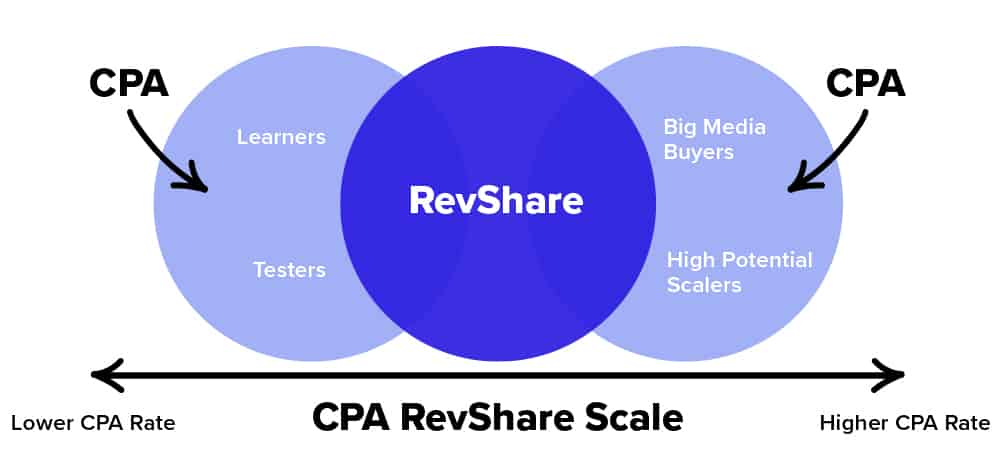

Generally, you’ll have two types of scenarios where CPA makes sense:

- A low CPA rate for learners and testers.

- A high CPA rate for big media buying affiliates looking to scale.

For everyone else, RevShare is typically the way to go, as demonstrated in our CPA/RevShare Scale graphic below.

In fact, what you’ll find is that the majority of non-media buying affiliates prefer RevShare. This is because they’re working with a quality email list or social community they’ve built up over time, and they actually expect to see a higher average order value and lower refund rate from their warm traffic as compared to the cold traffic sent from a big media buyer.

You can think about it with this VERY simplified rule of thumb regarding traffic…

Media buyers = Quantity > Quality

Email/organic/other = Quality > Quantity

It’s important to understand this, because generally, most affiliates will be more than happy with RevShare. Where you’ll see interest in CPA is from affiliates who primarily scale Facebook Ads, native ads, YouTube Ads, etc.

How to Use the CPA/RevShare Scale

With this rule of thumb in mind, you can generally assume that affiliates who inquire about CPA are media buyers.

So, when you go to determine which of your affiliates should earn CPA commission – as well as the amount they should earn – it’s nice to have a visual tool to gauge where each affiliate appears on this CPA/RevShare Scale.

According to Mychal Lowman, ClickBank Affiliate Manager, it’s key that you get to know more about each affiliate and their experience with affiliate marketing. This will help you determine what type of commission and rate an affiliate should earn. A simple conversation with the affiliate – plus a look at the CPA/RevShare Scale – will help you decide what makes sense for your affiliates.

“It comes down to communicating with potential affiliates during the vetting process,” says Lowman.

“CPA isn’t a ‘set it and forget it’ commission type. You should only offer a CPA commission rate after having a conversation with the affiliate and learning about their goals, if they plan to promote your offer for the long-term or short-term, and if they can scale based on their ad budget. All of these questions will help you protect yourself and utilize the affiliate to the best of the affiliate’s ability.”

According to the CPA/RevShare Scale, a concept developed by Lowman, CPA should be considered on the low and high ends of the spectrum. Affiliates that fall in the middle (novice affiliates, affiliates who are familiar with the affiliate marketing landscape, etc.) are better suited for RevShare. They have the experience to plan for returns and are more experienced with digital marketing than an affiliate who’s just getting started.

For your beginner affiliates, offering a low CPA rate can help them get their affiliate marketing sea legs. You might also see experienced affiliates willing to accept a low CPA rate so they can test a brand-new offer while limiting their downside. Either way, when you’re dealing with affiliates with a tight budget, offering them a low CPA rate can help them plan their promotions better.

On the opposite side of the spectrum, big media buyers often require a CPA rate to promote and scale offers. This is because these affiliates often have the ideal ad spend for particular offers down to a science. They know exactly what they need to be profitable and have the experience to scale faster and farther than beginner affiliates or those who are just testing out an offer.

“Pinpoint who your affiliate is and where they fall on this spectrum,” says Lowman. “Without that initial conversation, you’ll end up making assumptions about the affiliate that can be damaging to you and set the affiliate up for failure.”

Making Sense of CPA Commission and Returns

So, you can see the main use cases for CPA, but so far, most of this probably seems to be for the affiliate’s benefit, right? After all, they get the benefit of a guaranteed payout per sale without worrying about refunds or chargebacks.

The question is, what’s YOUR incentive to shoulder the additional risk that comes with offering CPA to affiliates?

Well, here’s the quick version: If you want big media buying affiliates to stick with you and scale your offer over the long term, CPA commissions will:

- Encourage them to work with you in the first place; AND

- Maximize their ad investment once they start promoting your offer.

Secondarily, CPA can be a great tool to get new affiliates on board with your offer early, because they can get quickly get a handle on how much they’re earning without any nasty refund surprises later.

CPA as a Momentum Builder

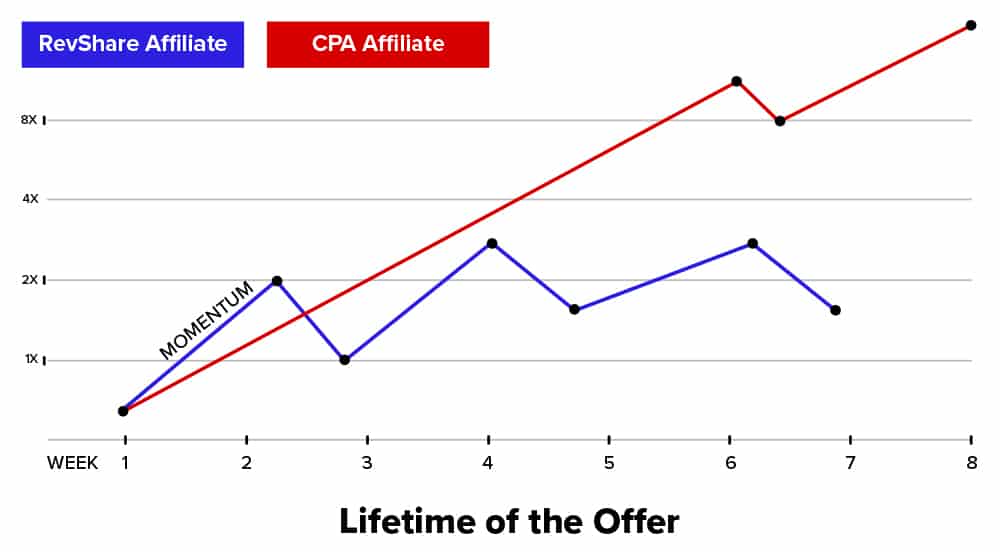

Ultimately, the name of the game in media buying for affiliate offers is momentum.

Take a look at the following graph, and you’ll see what can happen with a RevShare affiliate versus a CPA affiliate on the same exact offer and timeframe:

The CPA commission structure helps keep momentum going by freeing up more funds to reinvest in ads, as well maintaining full continuity for ad optimization over time. Think of CPA as a “momentum builder.”

RevShare, on the other hand, is a potential “momentum killer” for media buyers. This commission structure has 3 potential ways to slow momentum down in the same timeframe:

- Cash flow issues. On RevShare, ClickBank uses dynamic withholding to make sure we can cover any future refunds and chargebacks from affiliate sales. If we hold onto 10% of the funds a media buyer would be using to scale your offer, that slows them down considerably and may cause them to move onto a new offer before they even get that money released.

- Fraud detection concerns. Ad platforms like Facebook are wary about wild swings in ad spend, so if refunds or cash flow issues on RevShare cause an affiliate to curtail or stop their spending, they can’t just ramp back up right away.

- Unoptimized ads. Any dip or gap in ad spend can make it harder to optimize and pinpoint the best-performing ads, sometimes requiring a “restart” to an ad campaign. This can dramatically limit the success and profitability of any big media buying campaign – and in some cases, it’ll cause the affiliate to end a campaign prematurely.

You can see why your affiliates need all of these ingredients to keep momentum up. CPA is a lot more conducive to these major ad buying campaigns.

What’s In It For You?

Clearly, it’s great for affiliates to have the consistency and predictability of CPA. But what’s in it for you?

If you want the honest truth, CPA doesn’t really offer any direct benefit for sellers. You put yourself at greater financial risk to offer CPA instead of RevShare (especially if you don’t know what you’re doing).

But if you use CPA properly, you can dramatically increase the volume of total affiliate sales for your product and make a LOT more money overall. Think of CPA as a way to remove obstacles for media buyers to do what they do best.

Want a more concrete example? Here’s how CPA and RevShare look in action.

An Example of CPA vs. RevShare in Action

It’s always helpful to see at least one example of the difference CPA can make in the real world.

We’ve changed everything to generic names and numbers, but the below example is based on actual CPA success stories that our affiliate manager, Mychal Lowman, has seen with his clients.

Say you’re selling a physical supplement product on ClickBank: Health Supplement Pro. You see an average order value of $150 and offer a 65% commission on RevShare, which gives your affiliates an average payout of $100 per commission. You also see an average refund rate of 5%.

You’ve only offered RevShare so far, but you decide to switch over to CPA for a few of your best affiliates.

Here’s what this could look like, first starting with RevShare and second, making the move to CPA.

RevShare

Over a 12-week period, one of your affiliates invests $1.2M into Facebook Ads promoting Health Supplement Pro. With an average conversion rate of 1% and a CPC of $0.80, the affiliate ends this campaign with a total of 1.5M clicks and a total payout of $1.5M.

- 1.5M clicks * .01 = 15,000 sales

- 15000 * $100 per sale = $1.5M in commissions paid out to the affiliate

Subtract the $1.2M in ad spend and the affiliate clears $300K minus any subsequent refunds, or roughly 3% of $1.5M (an estimated $45,000), which leaves $255,000 in net profit.

And what does this look like for you as the seller? You would see a total of $2.25M in revenue (order value of $150 * 15,000 sales).

Now, let’s subtract the $1.5M paid to the affiliate. Let’s also deduct a full 10% for COGS and another 2% for your portion of refunds, and you’d have a total of $480,000 in net profit.

CPA

The difficult thing about comparing a RevShare scenario to CPA is that no niche, offer, or affiliate are exactly the same. With that said, we can approximate how the same offer might perform on Facebook Ads for an affiliate on CPA instead of RevShare.

In this case, the starting numbers would be about the same, except that you’d almost certainly offer a lower CPA rate (say $80 or $90 instead of the typical $100 APV seen on RevShare) to offset your increased refund risk.

Here are some other points that might look different with a CPA offer:

- A better caliber of media buyer decides to promote your offer – one that would only consider CPA opportunities.

- The affiliate can afford to promote the offer for a few additional weeks, because they don’t have to worry about money being withheld to cover refunds.

- The affiliate is able to obtain more total clicks at a more favorable CPC, because they had the runway to scale their winning ads.

- The affiliate is able to reinvest more money earned from promoting YOUR offer into further promoting your offer, instead of into someone else’s offer.

As a result, say the affiliate saw an average CPC of $0.75 and 2M total clicks with a higher total ad spend of $1.5M, all at a CPA rate of $90 per sale. Let’s hold steady the 1% conversion rate, AOV of $150, and refund rate of 5%.

- 2M clicks * .01 = 20,000 sales

- 20,000 * $90 per sale = $1.8M in commission paid out to the affiliate

Subtract the $1.5M in ad spend and the affiliate clears $300K in net profit (with no deduction for refunds).

And what does this look like for the seller (ie you)?

You would see a total of $3M in revenue (order value of $150 * 20,000 sales). Subtract the $1.8M in commissions to the affiliate, the 10% for COGS, and another 5% for refunds, and you’d see a total of $750,000 in net profit.

The Takeaway

We admit, these are hypothetical numbers. Things like average payouts, refund rates, CPCs, and the CPA commission rate will shift a lot over the course of a campaign – but this example demonstrates the potential for both affiliate and seller to earn more money overall with a more successful paid ad campaign, as made possible by CPA on ClickBank!

6 Insights from Expert CPA Seller: Mike at Biofit

Now that we’ve seen a theoretical example of how CPA can help, it’s time to get down to brass tacks. We connected with one of our top CPA sellers, Mike at Biofit, to share how to make CPA work for you in practice.

Here are a few of his insightful comments about CPA on ClickBank!

1. Affiliates shouldn’t ask for (or receive) the same rate on CPA.

In the marketplace, affiliates will see an average order value amount of $180 on a big offer, for example. Then, they assume they should be paid something like $160 for a CPA rate (which is tough for us on top of product costs and refunds).

It’s important to remind affiliates that they shouldn’t expect the same rate with CPA as they would get on RevShare. Don’t be afraid to explain this concept to new affiliates and hold firm.

2. I personally like the RevShare model.

As a vendor, I personally prefer RevShare. We used CPA on other networks over the years, but it’s always harder to mess things up when you’re paying affiliates on a percentage basis.

With CPA, you have to do more monitoring of quality with affiliates. It’s definitely not as passive as RevShare.

But I do appreciate both models for different reasons. It’s great to have the CPA option to keep affiliates happy. RevShare is the better option on the vendor side, but affiliates do prefer CPA. We just need all the numbers to align for it to work.

3. Always start with a provisional rate.

There’s always a tug of war when setting CPA rates for affiliates, especially newer ones. This is inevitable because affiliates want as much as they can get for their efforts, and they don’t always factor in the extra burden placed on a vendor shouldering the full risk of refunds and chargebacks.

It’s also difficult to screen affiliates ahead of time. It’s still worth having a conversation with a potential affiliate, but ultimately, your best bet is to start the affiliate at a lower CPA until the history is there. Once you see their refund rate and can verify no chargeback issues, then you can safely boost their CPA rate.

We have enough experience to know which affiliates push good numbers and have quality traffic. But in general, you should either have affiliates promote your offer on RevShare for a while or give them that provisional CPA rate until you can confirm their traffic quality.

4. Understand the CPA Calculator.

When I’m putting in an affiliate using the ClickBank CPA Calculator, it might say $160 is the most you can offer an affiliate one day, and another day, it’s $154. This is because it pulls a few different numbers from historical data (both from your side AND from the affiliate’s side), including refund rate and affiliate sales.

This is something to be aware of when you negotiate the CPA rate with an affiliate – the numbers can change. That’s one reason why it’s a good idea to start a little lower and go up from there.

5. Optimize your offer and the rest will follow.

A lot of vendors might ask whether you need to finetune your offer and upsell flow for CPA specifically, as compared to RevShare.

In my opinion, the answer is no. You just want the offer optimized as much as possible, regardless of the commission structure. The calculator does a good job of incorporating all of that data anyway.

So, for example, if we manage to increase the conversion rate for one of our upsells and boost the average order value by an extra $10 per order, eventually the CPA Calculator will incorporate that data and allow for higher CPA rates to our affiliates.

6. Start low and get data before your scale.

If you have never worked with CPA, I recommend starting low and getting data before you try to scale. You need time for calculations.

What you don’t want is to have what looks like good traffic from a CPA affiliate for a few weeks, followed by a cascade of refunds – with no recourse on your part. Nothing keeps affiliates honest on CPA (except the prospect of a good relationship with you), so don’t be afraid to offer a lower rate upfront.

Lastly, don’t be afraid to stick with RevShare if that’s working for you. CPA may open up avenues to some affiliates who don’t want to worry about RevShare, but the decision is totally up to you!

CPA FAQs for Sellers

We have a number of common questions about CPA from sellers. Here are a few of our top ones.

1) Why should I offer CPA?

By offering CPA, you attract the type of affiliates who only promote (or prefer) CPA offers because of the predictability that this commission structure provides. These affiliates typically have a larger ad budget and can generate a level of traffic that you wouldn’t be able to achieve otherwise. Even though you’re accepting the liability for returns, with super-affiliates, you’ll still be able to generate more sales overall.

The cherry on top is that, by offering CPA, you don’t limit yourself to only that type of commission. You can still allow revenue share (RevShare) commission on the same offer, while offering CPA only to affiliates you trust.

2) How can I let affiliates know that I am willing to offer CPA commission?

You can let affiliates know that you’re willing to offer CPA commission via your ClickBank Marketplace listing.

3) Who is the ideal CPA affiliate?

The ideal CPA affiliate could be any affiliate who wants to earn their commission upfront at a set amount. This appeals most to affiliates who have high ad spend costs and require predictability to manage and optimize their ad campaigns.

There are many different types of affiliates who want to promote CPA, including general affiliates who prefer the simplicity of the model. The best way to figure out which affiliates are ideal for you is to get to know them through conversation.

4) I’m a seller who is inexperienced with CPA. How do I know if I’m ready to offer CPA?

Run your numbers. Before you jump into CPA, really get to know what you’re earning, what your current affiliates are earning, and what you stand to earn with super-affiliates promoting on CPA. This kind of deep dive will level up your game as a seller in general and also help you familiarize yourself with CPA.

For new CPA sellers, it’s especially important to know the risks associated with CPA. As a seller offering CPA, you assume the burden of all returns. This means that affiliates who promote for CPA commission and facilitate a conversion will not be on the hook if that customer requests a return.

If you do go negative on CPA, your offer will automatically switch back to RevShare as a safeguard for both sellers and affiliates.

5) Can I pay more in CPA commission than the price of the initial purchase in my sales funnel?

Yes! CPA commission can be more than the value of your initial sale, but cannot exceed the value of the total order, which includes initial sale, order bump, and all upsells.

If we haven’t answered all of your questions here in this guide, we invite you to check out the full list of CPA FAQs for Sellers in our knowledgebase.

One Affiliate Can Change Your Trajectory

As we wrap up this guide, I want to leave you with a single key takeaway: it just takes one CPA affiliate!

While CPA requires more expertise and supervision than RevShare does, it’s also an opportunity to get your offer promoted by some of the best affiliates in the business.

Case in point: We have one seller whose offer got promoted by a new affiliate who came on platform specifically because CPA was an option. Due to this ONE affiliate’s efforts, the seller made an extra $47K in profit!

Plus, the total sales generated from this affiliate ALONE were enough for the seller to qualify for ClickBank’s Platinum program, which means access to exclusive ClickBank events and the opportunity to network with other top affiliates.

One big affiliate can also build HUGE momentum for your offer, including a boost to your offer’s Gravity score and more data you can tout when recruiting other affiliates. It could even land your offer on our ClickBank Top Offers blog post and YouTube series (which occasionally highlight top CPA offers specifically).

As many sellers in this space like to say:

Just one affiliate can change the outcome of your offer.

Even if you only made, say, $3K in profit from a bigger CPA affiliate, that’s extra money you wouldn’t have seen without CPA. Don’t leave cash on the table with your offer – explore the incredible possibilities of CPA on ClickBank!

CPA Seller Guide Conclusion

Ultimately, there’s a LOT more to CPA than we could possibly cover in this one guide, but we hope this explains why CPA is useful and helps you get started.

If you need more information on CPA, we have a number of additional resources below that you can check out:

- ClickBank CPA page

- CPA Marketing guide

- CPA vs RevShare guide

- How to Use CPA on ClickBank

- CPA FAQs for Sellers

You can also reach out to ClickBank support anytime if you have specific questions about your account or offer. We look forward to seeing your CPA offer on ClickBank very soon!