These days, there are nearly limitless ways that someone can earn a living online in our digitally connected world. One popular way that millions of people earn at least some of their income is through affiliate marketing, and that number is growing rapidly – as of 2024, affiliate marketing has become a more than $27.8 billion market.

Beyond that, an estimated 16% of all online orders placed in the United States originate because of an affiliate marketing strategy. Clearly, there’s a lot of demand for people who can apply their digital marketing skills to promoting products and generating commissions for themselves.

But if you’re considering becoming a successful affiliate marketer – or if you’re already on your way there – then you need to understand affiliate marketing taxes. I get that just like my article on affiliate link disclosure, an article about taxes isn’t the sexiest or most exciting, but it’s important to understand. Let’s take a deep dive into this critical aspect of how to manage your affiliate marketing business!

Is Affiliate Marketing Taxable?

Affiliate marketing is taxable, just like any type of legitimate work. Some affiliate marketers are earning as much as $5 million or more per year! I’ve had the privilege of interviewing several of them and learning their stories – here’s an example of one below.

Affiliates like Francisco have fully dedicated themselves to their affiliate marketing careers and treat what they do like a business – because it is one! They also spend a significant amount of time building out their network via Clickbank.

Obviously, earning revenue at that level means that they’ll owe some serious taxes on that money. But let’s be clear: Affiliates are NOT responsible for collecting sales taxes on the products they promote, because they’re not directly selling the product.

Instead, they are referring customers to the product through their special tracking link (aka “hoplink” on ClickBank) and receiving a portion of every sale they generate. That means you as the affiliate will only pay taxes on the earnings you receive, paid straight out from ClickBank on behalf of the sellers or brands whose products you’re promoting. Note that your portion as the affiliate comes after sales taxes and ClickBank’s fee are taken off the top.

Make sense? I hope so!

If it’s still a little fuzzy, we map out a transaction on ClickBank in the following helpful resource on how ClickBank works.

That guide is definitely worth checking out!

Affiliate Marketing Taxes in the US

Okay, so those based in the US who earn income via affiliate marketing do so on what’s known as a 1099 basis.

This refers to the 1099 form that these individuals file with the Internal Revenue Service (IRS) when they file their taxes. If you earn money via affiliate marketing, you do NOT do so as a traditional employee! Instead, you are acting as a freelancer or independent contractor.

Independent contractors must follow a specific set of rules related to how they pay their taxes. They must file their taxes every quarter if they earn or expect to earn $600 or more for the year via their independent contractor activities.

This is because the earnings that affiliate marketers make are not initially withheld for taxes at all. Instead, the independent contractor must stay on top of their earnings and ensure that they report them accurately to the IRS. They must also pay their taxes out of those earnings correctly so that they can cover what they owe to the government.

Those who sign up for ClickBank will receive their 1099 form directly from ClickBank before tax time, if they earn more than $600 from their affiliate marketing activities for the year! Those who fall under the threshold will not receive this form.

Self-Employed vs Business Owner

One question affiliates often ask is if they should operate as a sole proprietor or set up their business as some kind of corporation for tax purposes. Obviously, this decision can have significant implications for how your income is counted and taxed in the eyes of the government.

Helloskip.com offers this helpful information about the difference between being self-employed and being a small business owner:

All business owners are self-employed, but not all self-employed are small business owners. While being self-employed is defined as being your own boss, being a small business owner is simply characterized by having others work for you. As a small business owner, you can hire independent contractors or employees.

They go on to point out that, as a small business owner, you can hire and fire independent contractors and/or employees. However, you should keep in mind that collecting taxes on the wages of those workers is also your responsibility.

You may also need to:

- Offer benefits such as personal time off (PTO)

- Carry worker’s compensation insurance

- Create a Human Resources (HR) department

It might seem appealing in some ways to declare yourself a small business owner, but there are a huge number of responsibilities that come with taking on that responsibility. Many who operate as affiliate marketers opt to remain independent contractors.

In fact, here at ClickBank, we see a LOT of solo Platinum affiliates (those who make $250K per year or more in sales on our platform). From a tax standpoint, being a sole proprietor gives you fewer options in how to shield your income from taxes, but there’s more complexity in operating a limited liability corporation (LLC) or other corporate structure.

You also need to remember that operating as an LLC or other corporate entity will help protect you personally from liability in the event of a lawsuit.

Affiliate Marketing Taxes in the UK

The United States is not the only country that taxes income earned via affiliate marketing. In fact, most countries do!

In the United Kingdom, you can earn up to £1,000 in one tax year before you have to concern yourself with paying taxes on your affiliate earnings. However, once you cross that number, you will be responsible for paying into the system.

There is another set of taxes in the United Kingdom known as “Value Added Taxes” or VAT that you may have to register with the HMRC for, if your income from affiliate marketing generates more than £85,000 in the past 12 months. However, keep in mind that if you’re an affiliate, the “sale” itself is already taxed based on where the buyer is. You probably won’t need to charge and collect VAT unless you’re a product owner or ecommerce brand making product sales directly.

Affiliate Marketing Taxes Around the World

Affiliate marketers earn their income all over the world. In my earlier example with Francisco, we actually met him where he lived in Concón, Chile!

Affiliates aren’t isolated to any specific geographic area, which means they must carefully consider how much they owe in taxes within their own country. Fortunately, many countries have tax treaties with one another that prevent individuals from being double-taxed on their income.

For example, those who sell products on Amazon can take comfort in the fact that numerous countries have a tax treaty with the United States that prevents double taxation. Those countries include:

- Canada

- Mexico

- The UK

- France

- Germany

- Italy

- Spain

- India

- China

- Japan

- Australia

Many affiliate marketers find that a significant portion of their income comes from products that they market in one of those countries. Thus, you won’t have anything to concern yourself with when it comes to the possibility of double taxation.

Instead, you should simply focus on paying the appropriate amount of taxes on your income based on the laws set out in your domestic market. As long as you can do that, you’ll be in good shape!

3 Tips for Affiliate Marketing Taxes

Having a few strategies under your belt for how to pay your affiliate marketing taxes can help you minimize the portion of your income that you hand over to the government each year. A few of the strategies worth looking at include the following:

1) Track Expenses and Take Tax Deductions

When working with ClickBank, you need to focus not only on when you will get paid but also on the expenses related to your affiliate marketing efforts. It’s important to take every tax deduction you legally can to minimize taxes on the income that you earn. A few examples may include:

- Insurance

- Travel

- Depreciation

- Office supplies

- Home office

- Employee compensation

By keeping good records of your expenses all year, you’ll be able to deduct more from your taxes, which means more of your affiliate income will stay in your pocket!

2) Make Quarterly Estimated Payments

Some people think that they can get caught up in paying their taxes at the end of the year. However, that is often a huge mistake. Making quarterly estimated payments is the better way to go, for a few reasons.

For one thing, in the US, the IRS insists that you make quarterly estimated tax payments. Obviously, you run the risk of an audit and penalties if you don’t abide by that important rule.

Second of all, if you consistently make quarterly estimated payments with an educated guess about your likely income for the year, then you won’t have to worry about an unmanageable bill you can’t afford once tax time arrives. Nobody wants that!

3) Use Accounting Software (or ClickBank!)

The good news for any affiliate working with ClickBank is that you won’t have to worry as much about tracking every single dollar for accounting purposes. ClickBank does most of the heavy lifting of routing funds for all parties on a transaction.

In the US, if you earn more than $600 throughout the year, then ClickBank will automatically send you a 1099 form at the end of the year that tells you what you actually earned on ClickBank. You can use those figures to file your taxes properly!

Bonus: Consult with a Tax Professional

I’ve tried to provide some good general information in this article, but none of this should be construed as legal or tax advice! The more successful you are, the more complicated your business and personal income situation will usually be – so nothing I say can take your own circumstances into account.

With that said, if you’re starting to hit your stride as an affiliate, I highly recommend you invest a small portion of what you’re earning to get clear on your tax obligations, set up the proper business entity, and ensure you always pay the affiliate marketing taxes you owe!

Final Takeaways

Filing your affiliate marketing taxes properly is important! Especially for anyone coming from a 9-to-5 background, you should be aware that you’ll owe taxes on income generated through affiliate commissions.

But the good news is, ClickBank takes most of the burden off your shoulders by keeping detailed records of every sale and transaction, then automatically routing the funds where they need to go, including the commissions you earn going right into your bank account.

This allows you to focus less on tedious tasks like emailing vendors to ask for your affiliate payouts or handling more complex taxes that are typically associated with running your own business. Just note that as an affiliate, you’re ultimately responsible for following all of the tax rules where you live!

Want more information on the topic of affiliate marketing taxes? Check out our Affiliated podcast episode on the subject:

Grow Your Affiliate Income with Spark by ClickBank

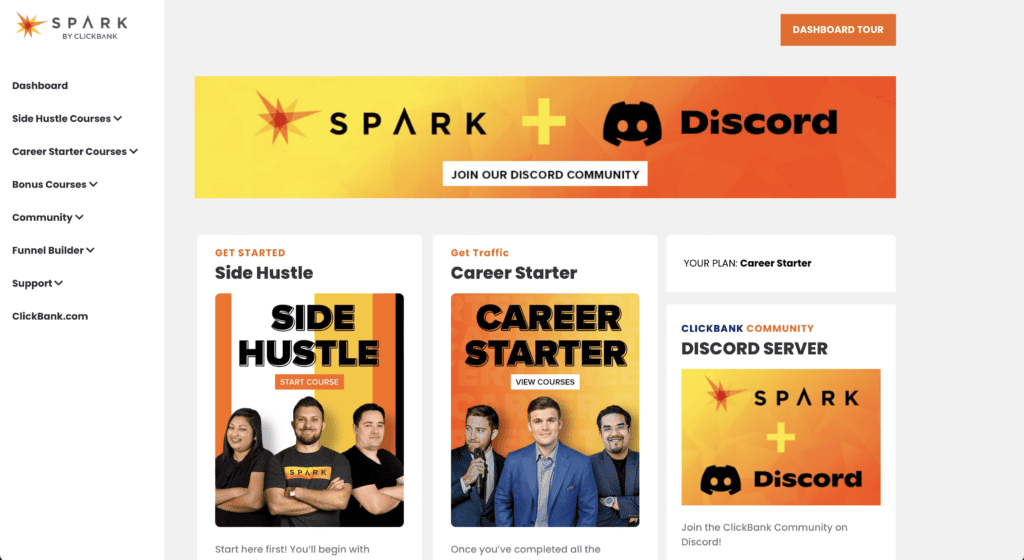

For more information on growing your affiliate marketing business (so that you earn enough to actually worry about affiliate marketing taxes!), be sure to check out Spark by ClickBank, the official affiliate education platform from ClickBank.

Inside, you’ll find a wealth of valuable courses, an active community, and time-saving tools to support your growth as an affiliate, whether you promote products with free traffic or paid traffic methods.

No matter where you are on your affiliate marketing journey, Spark by ClickBank has insights from the industry’s top experts to help you get to the next level. See you inside!