In the world of affiliate marketing, there are vendors who create amazing products that convert well, and affiliates who market those products to interested buyers (in exchange for a commission on each sale).

This legendary business relationship is a win-win for everyone involved, but there’s still an important question that these partnerships must answer: who gets what?

As it turns out, there are many ways to slice the pie – and the size of YOUR slice depends on the set of rules you start with!

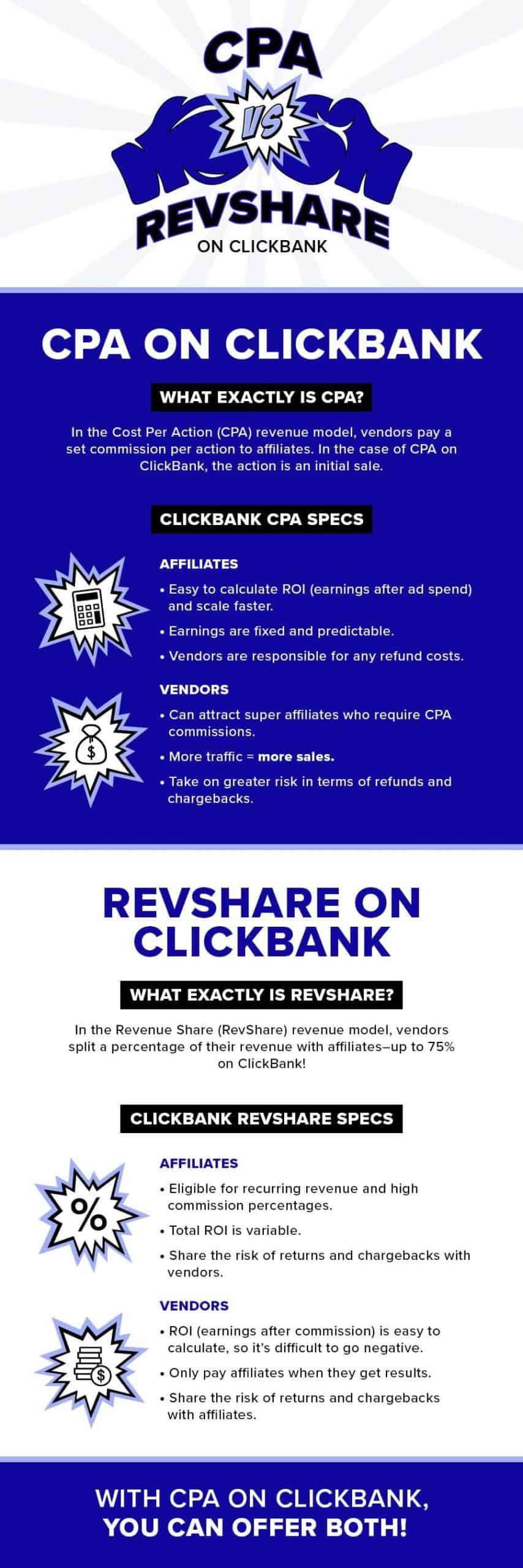

So, in this post, we’re doing a deep dive into the two biggest affiliate revenue models out there: CPA vs RevShare. Hopefully, this will help you decide whether CPA or RevShare is the better choice for your business.

What Is CPA?

First, let’s talk about CPA marketing, the most popular commission model for big-name affiliates looking to spend a lot on media buys.

Cost Per Action (CPA) is an affiliate revenue model where vendors pay a set amount in commission to affiliates (per action).

The most common type of action we see in CPA affiliate marketing is the sale. With a cost per sale (CPS) model, each time a customer makes a purchase, this action triggers the payment of a predetermined dollar amount to the affiliate, regardless of what the total order value is.

CPA Example

To illustrate the point, let’s look at an example of CPA.

Say an affiliate sends one customer over to one of the top products on ClickBank. This particular offer sells for $37 (or ~ $46 with shipping if the customer chooses the physical product), but it also includes 3 upsells totaling just over $150.

Whether the total order value is $37 or $151, the affiliate will get a consistent payout for each sale, as set by the vendor upfront (such as $60). This number is the same no matter what – even if the customer only buys the $37 product, the affiliate still receives this higher $60 payout for any sale.

With a CPA model, the affiliate will always earn a fixed amount based on each initial sale in the sales funnel. We’ll touch on why this is so attractive to affiliates in a little bit.

What Is RevShare?

The main alternative to CPA is RevShare, a model that ClickBank is very familiar with. So, what does “RevShare” mean?

Revenue Share (RevShare) is a revenue model where vendors split their revenue with affiliates on a percentage basis. On ClickBank, the standard affiliate commission can be anywhere from 1% to 75% (or up to 100% on commission tiers).

Keep in mind that RevShare is based on not just the initial purchase, but any upsells that the customer buys as well.

RevShare Example

If we go back to our example, there’s a 75% commission rate for this product on ClickBank. So, if an affiliate drives one sale of the initial offer, that 75% is applied to the total order value of $37 (75% of $37) for a $27.75 affiliate commission.

But if the customer buys all the upsells in this offer flow, the total order value of up to $151 would mean an affiliate commission of $113.25. (Of course, this is assuming that the vendor has set the same commission rate for each product in the funnel. On ClickBank, vendors can choose varying percentages for different offers in the order flow, such as 75% on the first sale, 30% on the first upsell, 50% on the second, and 0% on the third.)

With a percentage-based commission, revenue share can be a LOT more profitable for affiliates in the long run!

But there’s a big caveat here, because the word “share” goes both ways: In the revenue share model, affiliates share in the sales, but they also share in the returns(ie refunds and chargebacks).

CPA vs RevShare: At a Glance

Below, you can see a quick chart to help you understand the breakdown of both affiliate revenue models for affiliates and vendors.

| % vs $ | Returns | Burden of Math | |

| CPA | $ for Affiliates | Vendor | Vendor |

| RevShare | % for Affiliates | Both | Affiliate |

NOTE: “Burden of Math” refers to the party that has to do math to ensure they’ll be profitable.

Why One Affiliate Revenue Model Over the Other?

Just like with anything else, these two tried-and-true revenue models each come with their own pros and cons.

Let’s dive into the merits of CPA and RevShare for both vendors and affiliates, so you know what you’re getting into with either approach!

What You Get With CPA…

What You Get With RevShare…

Frequently Asked Questions

What is the main difference between CPA and RevShare?

The main difference is in how affiliates get paid. With CPA, you’ll usually see a set commission per sale, while with RevShare, affiliates receive a percentage of the total order value.

What Are the Other Types of CPA Actions?

While Cost Per Sale (CPS) is the most common type of CPA action in affiliate marketing, there are some other actions that people will pay for in the digital advertising world.

Here are the most common you’ll see:

Cost Per Click (CPC). Clicks are a common type of action used in paid ads, though less common in affiliate marketing specifically.

Cost Per Lead (CPL). In high-ticket businesses that require more sales nurturing, you may find companies willing to pay for leads as opposed to sales. However, be aware of the terms to make sure you know what counts as a “qualified lead.”

Cost Per Install (CPI). In the mobile app business, a developer will only pay for an ad that directly led to a user installing the app on their device.

NOTE: CPA can apply both to pricing models and pay-for-performance models, but in this case, we’re just talking about it in terms of pay-for-performance.

What makes Cost Per Sale great for vendors is that they only pay for a completed action. If you pay for a lead or a click or an impression, you’re taking on greater risk if they don’t result in sales.

CPA vs RevShare Roundup: Which is Better for You?

Ultimately, the answer to which affiliate revenue model works best for you is, “It depends!”

On the vendor side, CPA means you’re solely liable for refunds and chargebacks, but you can attract the biggest affiliates – and if you do your math right, your overall sales can be much higher with CPA.

On the affiliate side, CPA allows you to know exactly how much you’ll earn for every conversion you make, which is huge in determining the total spend on paid ads and other marketing campaigns.

If you’re interested in getting started with affiliate marketing or selling products, we encourage you to sign up with ClickBank. We have the experience and support to help you reach your affiliate marketing goals!

CPA Has Arrived on ClickBank

At ClickBank, we work hard to handle the nuts and bolts of affiliate marketing for our vendors and affiliates. One of the ways we do this is by automating the payment process. This takes a lot of accounting and legal wrangling off your plate so you can focus on getting sales and growing your business!

As you probably know, we’ve traditionally operated on a revenue share model, but we’re excited to announce a cost-per-action (CPA) option – available now!

This has been in the works for a long time because we wanted to make sure to do this important feature justice. We promise, our version of CPA has been worth the wait, with lots of exciting features to make your life easier! Check out the best CPA network right here!